Winning the Digital Shelf: A Strategic CPG Guide for Retail Media & Commerce

Discover 5 best practices every CPG brand needs to compete and grow across Amazon, Walmart, Instacart, and more. From PDP optimization to real-time campaign activation, this guide shows you how to capture share, protect margins, and build long-term loyalty.

• Proven strategies tailored for Grocery, Health, and Beauty categories

• How to align ads with shopper intent for maximum ROI

• Real-world playbooks to activate around seasonal peaks and market shifts

Win the Digital Shelf in 2025: Your CPG Retail Media Playbook

Enterprise brands and agencies navigating the increasingly competitive virtual aisles of CPG need more than broad best practices — they need category-specific strategies grounded in real shopper behavior. This guide provides exactly that. Drawing on Pacvue’s own internal data and benchmarks, it explores:

- Emerging consumer trends

- Winning approaches to PDPs

- Advertising tactics proven to drive performance on Amazon, Walmart, Target, Instacart, Sam’s Club, and more

Learn about the tools and strategies that boost visibility, build consumer trust, and improve conversion rates. This guide will empower you to succeed during peak seasonal moments while sustaining long-term growth in crowded categories.

Why CPG Brands Need a Shopper-Centric Strategy in 2025

A successful retail media strategy in 2025 hinges on one thing: an unwavering focus on the shopper. Consumers are evolving faster than ever; driven by heightened health awareness, rising expectations for transparency, and growing comfort with digital discovery across various categories. To compete, CPG brands must turn these shifts into agile, data-backed strategies that meet shoppers’ current needs and anticipate future ones.

Consumers Are Prioritizing Wellness-Linked Benefits Across Categories

Shoppers are no longer satisfied with products that merely meet basic needs. They want goods that support proactive wellness, purposeful living, and functional outcomes. According to NielsenIQ, 70% of consumers now say they actively manage their health, and 55% are willing to spend more than $100 per month on wellness.1 This willingness to invest signals long-term growth potential across the CPG, but it also raises the bar for differentiation.

- Function now defines value. From ingredient-led grocery staples to private-label alternatives, shoppers evaluate purchases based on the benefits they deliver. “Purpose-driven” and “preventive” attributes are influencing buying decisions in both traditional categories such as household cleaning, and emerging segments, like functional beverages.

- Cross-category convergence. Health cues are no longer siloed in the supplement aisle — as grocery brands continue to lean into superfoods and clean labels.

Regulatory & Labeling Expectations Are Rising Across CPG

Regulatory scrutiny and consumer demand for transparency are reshaping how brands present their products online. NielsenIQ finds that 82% of consumers say health and wellness labels need to be clearer and easier to understand, while 25% cite lack of trust in product efficacy as a barrier to purchase. 1

- Trust as a differentiator. Platforms are enforcing stricter compliance rules around claims and labeling, as shoppers expect to see ingredient transparency, recognized certifications (such as USDA Organic, Fair Trade, and Non-GMO), and data to support benefits claims.

- Compliance-forward PDPs stand out. In crowded categories, brands that lead with authenticity — showcasing supplement facts, clinical data, and recognized certifications — are winning shopper trust faster.

Brands Must Compete with DTC Agility and Private Label Efficiency

CPG brands are no longer just competing — they’re up against nimble direct-to-consumer (DTC) disruptors and private labels that are mastering affordability, speed, and shopper loyalty.

- DTC brands are fast, clean, and customer-obsessed. They capitalize on trend cycles quickly, optimize digital experiences in real time, and personalize offers at scale. Competing in 2025 requires matching this agility.

- Private labels are winning on value and quality. Nearly half of consumers report buying more private-label products than in the past (NielsenIQ).2 Particularly in grocery, retailer-owned brands are capturing more shelf and search share by offering competitive formulations at lower prices.

Category Deep Dives: 2025 Trends & Shopper Behavior

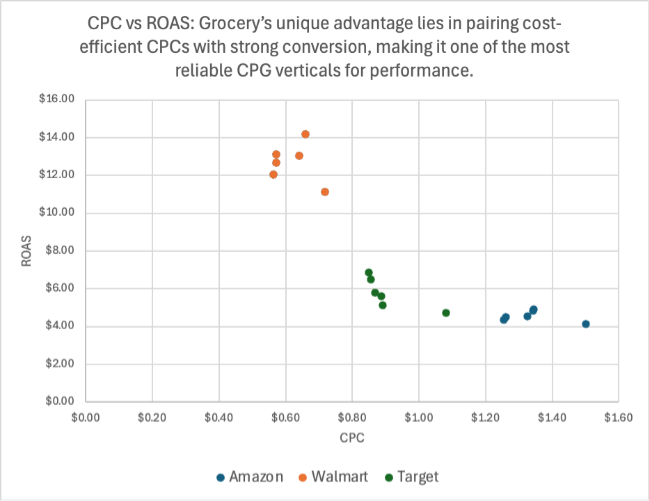

Among all CPG verticals, Grocery & Gourmet stands out as the most efficient for optimizing ROAS. In the first half of 2025, Pacvue’s internal data shows that Grocery & Gourmet consistently outperforms other categories, thanks to a mix of low CPCs and high conversion efficiency.3 For enterprise brands, this means Grocery & Gourmet remains a cornerstone investment area — but one where success depends on differentiation and precision, as competition intensifies around affordability, trust, and discoverability.

Grocery CPC Trends: Efficiency Holds Strong

CPCs in the grocery category have remained remarkably cost-efficient, averaging $0.60–$1.30 across platforms.3 Pacvue data show only modest fluctuations in the grocery category:

- Amazon CPCs declined slightly, from $1.50 in December 2023 to $1.34 in May 2025.

- Walmart CPCs rose modestly but continue to remain below $1 — delivering unmatched scalability for advertisers seeking reach and efficiency, particularly on value-tier and bulk-pack grocery items.

This CPC efficiency enables brands to scale investments without eroding profitability. Importantly, grocery is one of the few categories where low CPCs correlate with high ROAS, making it a model of efficiency that other verticals cannot easily replicate.

Grocery ROAS Leadership Across Platforms

ROAS improved year-on-year in the first half of 2025 across nearly every platform3:

- Walmart: Averaged $13.46, peaking above $14.20 in March 2025.

- Sam’s Club: Consistently above $13, with several months over $14 driven by club-size formats and repeat baskets.

- Amazon: Grew from $4.13 in Dec to $4.92 in May, reflecting gains from PDP optimization and premium pantry.

- Instacart: Averaged $5.25, influenced by convenience and immediate-needs orders.

- Target: Reached $5.77, reflecting balanced performance in household staples.

This performance makes the grocery category unique among CPG verticals: while others struggle with higher CPCs and reduced efficiency, grocery maintains a balance of affordability, volume, and conversions.

Grocery Ad Spend Patterns Across Platforms

Pacvue’s data reveals how brands are tailoring their grocery investments:

- Amazon & Instacart: Shows steady, incremental increases in ad spend, reflecting confidence in basket-building behaviors and shopper loyalty.

- Walmart & Sam’s Club: Exhibits sharp year-over-year lift during peak efficiency months like February and March, suggesting brands are activating aggressively when performance metrics align.

- Criteo & off-Amazon platforms: While smaller in scale, they demonstrate rising ROAS and ASP, indicating growth opportunities for niche brands in secondary discovery channels.

The key takeaway: a diversified media mix is essential. Brands benefit from combining Amazon’s premium scale, Walmart’s efficiency, and Instacart’s immediacy to achieve the best results in the grocery and gourmet sectors.

Health & Household Trends of 2025

Health & Household remains one of the most competitive CPG verticals in retail media, driven by a genuine wellness lifestyle shift.

CPCs in Health & Household = Highest Amongst CPG Verticals

According to Pacvue internal data, CPCs for Amazon Sponsored Products in this category are the highest among CPG verticals, averaging $2.23 and outpacing both Beauty ($1.53) and Grocery ($1.34).3 This cost dynamic reflects both strong shopper demand and the intensity of competition for visibility in a category where trust, product quality, and proven benefits are paramount.

While Amazon can sometimes face higher CPCs due to intense competition, CPCs on Walmart remained highly efficient at an average of $1.22.3 This efficiency helps support strong ROAS even on smaller ASPs, particularly in high-repeat categories such as vitamins, pain relief, and OTC wellness. For brands targeting households that prioritize affordability and frequency, Walmart provides a cost-effective channel to capture repeat conversions at scale.

ROAS Remains Stable with Competitive Pressure

Even with elevated CPCs, Pacvue benchmarks show that ROAS remained relatively stable, signaling that brands must work harder to maintain efficiency as competition intensifies.

- Amazon: ROAS averaged $3.11, remaining stable across the last six months and peaking modestly at $3.17 in March.

- Walmart: ROAS was higher at $4.25, with early-year highs above $4.50, reflecting Walmart’s growing role as a key health destination.

- Criteo: Delivered the strongest efficiency at $6.41, showcasing opportunities in alternative channels where competition is less, but conversion remains strong.Consistent ROAS and elevated ad spend reflect strong, steady shopper demand for wellness products, but also highlights the importance of competing aggressively for premium placements.

Ad Spend Grew Faster Than ROAS

Ad spend in this category increased 10-15% year over year, outpacing ROAS, indicating that brands must work harder to maintain returns as the category becomes more competitive.3

On Amazon, brand spend remained elevated month after month, underscoring its position as the core channel for full-funnel health marketing. Here, brands lean into premium pricing, advanced targeting, and robust PDP storytelling to capture traffic and drive conversions.

Meanwhile, Walmart demonstrated healthy year-over-year ad spend growth, reflecting the rise of multi-retailer activation strategies. Many brands are leveraging Walmart to balance value-driven households with in-store activation, where online ads directly and indirectly support brick-and-mortar performance.

Beauty & Personal Care Trends of 2025

Beauty & Personal Care remains one of the most resilient yet fiercely competitive verticals in retail media. Shoppers in this category are highly engaged, brand-loyal, and willing to pay for quality, which makes the space attractive for investment. At the same time, competition for premium placements continues to intensify.

According to Pacvue’s internal data, CPCs in Beauty & Personal Care have averaged mid-range across platforms, yet have trended upward on Amazon — while ROAS has remained stable. This dynamic highlights both the strength of consumer demand and the challenge of protecting efficiency as costs rise.

CPC Trends: Competition Rising, Efficiency Holding

NielsenIQ reports that the global beauty industry grew 7.3% in value year over year, reaching nearly $1 trillion.4 This scale explains why CPCs are rising as brands compete for digital visibility.

For example, Amazon CPCs averaged $1.49 across recent months, up from just over $1.25 at the start of the year. 3 This rising trend reflects competitive pressure around premium keywords, particularly in skincare, anti-aging, and seasonal hair categories.

Walmart and Target saw CPCs averaging $1.74 and $1.66, respectively — competitive, but still cost-efficient compared to Health & Household.

Despite Rising Costs, ROAS Remains Stable

- Amazon: Averaged $3.55, holding within a narrow band across six months despite CPC growth.

- Walmart and Target: Delivered steady performance, aligned with their positioning around high-velocity SKUs and price-sensitive essentials.

This combination of rising CPCs and stable ROAS suggests that while competition is increasing, shopper intent and conversion remain resilient. For brands, it means efficiency is still attainable — but only with well-optimized creative, PDP content, and media strategies that outpace competitors.

Ad Spend and Shopper Behavior

Pacvue’s data shows that investment by beauty brands on Amazon has grown consistently month over month, reflecting the platform’s continued role as the anchor platform for full-funnel beauty execution. From discovery to repeat purchase, Amazon allows beauty brands to balance acquisition and loyalty in one environment.

In contrast, Walmart and Target spend patterns are more conservative but equally strategic, aligned with their focus on high-velocity SKUs, drugstore essentials, and price-sensitive formats. These platforms remain critical for broad household reach and category entry, especially for masstige or dermatologist-recommended brands.

How Pacvue Helps Health, Grocery, and Beauty Brands Win

Optimize PDPs and Retail Readiness in One Unified View

Pacvue surfaces gaps and inconsistencies on your PDPs — from missing content to unclear value messaging. Brands can see exactly where to improve content when competition heats up.

Monitor Share of Shelf and Competitor Positioning

Pacvue tracks which brands are winning placements, what keywords drive visibility, and how competitors adjust spend. By monitoring share of shelf and share of search, grocery brands can defend high-value terms and proactively protect visibility.

Automate Campaigns Based on Real-Time Signals

Beyond seasonal peaks, demand can be unpredictable. Pacvue’s automation tools instantly adjust bids, budgets, and placements in response to live data, ensuring brands capture demand before competitors react.

Navigate Category-Specific Complexity with Custom Dashboards

Expectations differ sharply across retailers. Pacvue’s custom dashboards let grocery brands track what matters most — from dietary certifications and pack-size claims on Amazon, to bulk-value messaging on Walmart and Sam’s Club, to immediacy-driven demand on Instacart.

Achieving Sustained Growth in the CPG Category

By grounding strategy in real-time data, optimizing PDPs for speed and clarity, and activating around seasonal and household-driven demand, CPG brands can win both immediate baskets and long-term shopper loyalty.

- NielsenIQ. NIQ Report Reveals 2025 Global Health & Wellness Trends. Published May 28, 2025. [Link]

- NielsenIQ. Private Label and Branded Products: A Changing Shelfscape. Published April 28, 2025. [Link]

- Pacvue, Internal Data. Analysis of ad spend, CPC, and ROAS across retail media platforms. December 2024 – May 2025.

- NielsenIQ. NIQ Reports 7.3% Year-Over-Year Value Growth in Global Beauty Sector. Published February 25, 2025. [Link]

Download Pacvue’s Winning the Digital Shelf: CPG Retail Media Playbook 2025 to uncover 5 proven strategies for winning the digital shelf.