Amazon Prime Day 2025 marked a historic shift—spanning four full days and setting new benchmarks for retail media performance. Advertisers faced both greater opportunities and bigger challenges as shopper behaviors, ad spend, and competition evolved. Drawing from Pacvue and Helium 10’s latest data, here’s a first look at what made Prime Day 2025 unique—and what your team should do next.

1. The Four-Day Format Drove Record Sales—but Lower Daily Intensity

Prime Day 2025’s biggest story: lengthening the event to four days.

- Total brand average sales jumped 34% YoY

- Total ad spend soared 48% YoY

- But average daily sales fell 33% YoY, and average daily spend dipped 26% YoY

With the longer event window, both shoppers and brands stretched their activity across more days. This resulted in less intense daily competition than previous years, but higher aggregate results. While the pace changed, the opportunity to reach engaged shoppers increased.

Why it matters:

The new format rewards brands that practice smarter budget pacing, flexibility, and real-time optimization. Performance peaks can happen at different points—often late in the event—so the best results come to those ready to pivot quickly.

Action Item:

Track campaign pacing every day and be prepared to shift spend between days and even hours as new trends emerge.

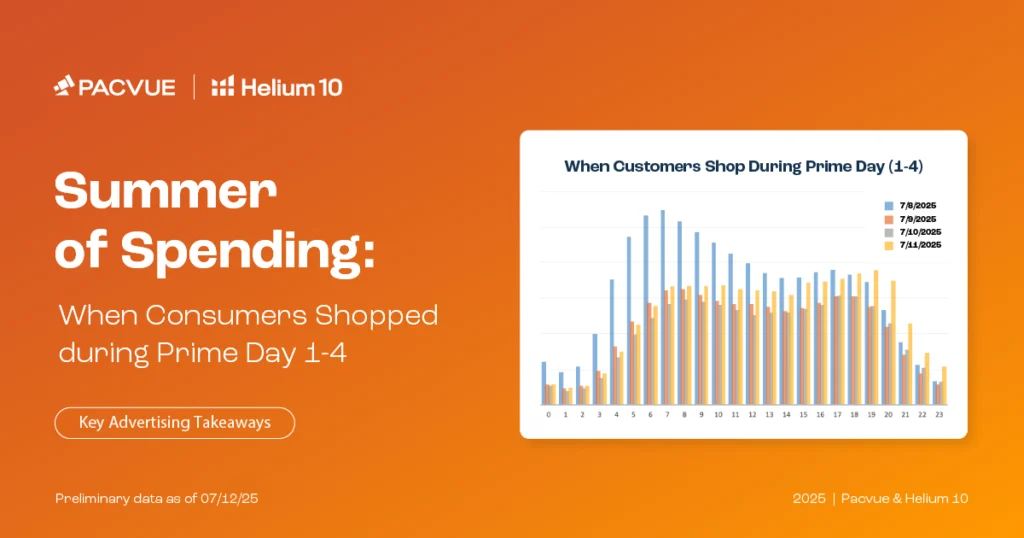

2. Shopping Patterns Shifted: Early Surges, Mid-Event Plateaus, and a Final Frenzy

- Day 1 (7/8): A pronounced early morning spike (5–8am), as deal hunters logged on before work.

- Days 2 & 3: Volume remained solid through mid-day and early evening, but with fewer dramatic surges.

- Day 4 (7/11): The final evening delivered a last push, with late shoppers driving a “closing rush” that lifted daily totals.

Shopping behavior shows less “FOMO” on Day 1 and more calculated shopping throughout the event, along with a sizable group of procrastinators jumping in at the end.

Why it matters:

Advertisers must resist the urge to front-load all spend. Being present—and agile—during both the opening and closing hours is critical.

Action Item:

Leverage hourly data for campaign dayparting. Shift budget to key hours and test creative for both early birds and last-chance shoppers.

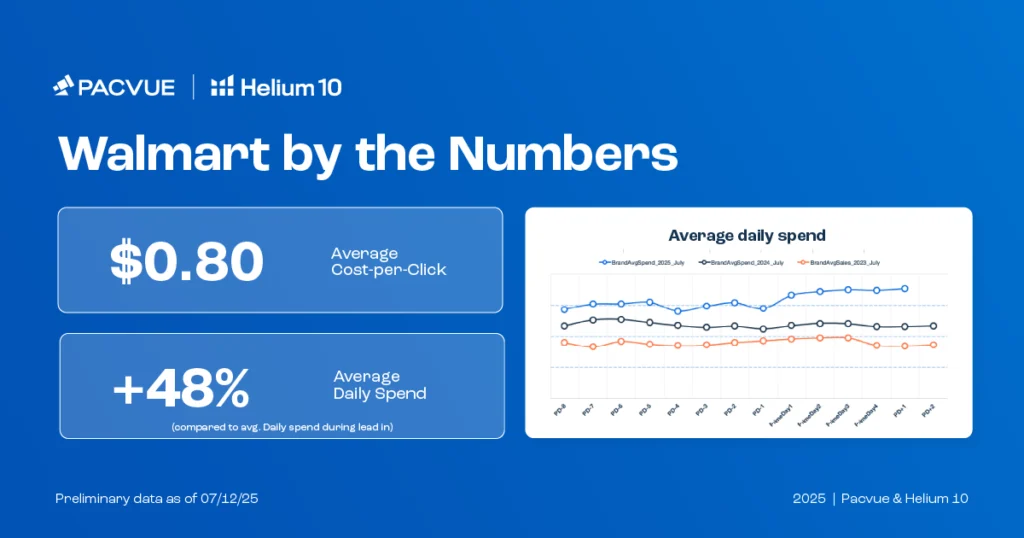

3. More Opportunity Across Retailers: Efficient Growth for Walmart and Target

Prime Day 2025 brought opportunity across all major retailers.

- Walmart’s average daily ad spend rose 48% compared to the pre-event period, with a highly efficient average CPC of $0.80.

- Target also saw robust growth, reflecting the importance of omnichannel strategies. Each platform offered unique advantages: Amazon brought unmatched scale; Walmart offered budget-friendly CPCs and increased visibility, while Target’s audience remained highly engaged.

Brands didn’t just prioritize one retailer—they coordinated campaigns and mirrored promotions to capture shopper’s attention wherever deals were found.

Why it matters:

Success during Prime Week now relies on harmonizing strategies across Amazon, Walmart, and Target. Each channel presents a unique opportunity, and shoppers are engaging with all of them.

Action Item:

Build cross-retailer campaigns that align messaging, deals, and creative, but are tailored to each platform’s strengths. Monitor channel-by-channel performance and optimize accordingly.

4. The Rise of Value-Driven and Comparison Shopping

Prime Day 2025 made it clear: today’s shoppers are more value-driven and better informed than ever.

- Nearly half of Prime Day shoppers compared prices on Walmart, and a third did so on Target.

- The majority of items sold on Amazon were under $20, with the average spend per item at $24.59.

This shift reflects shoppers’ focus on essentials and intentional spending—seeking out the best price, wherever it might be.

Consumers are savvier than ever—bouncing between platforms for the best price, and increasingly favoring lower-ASP, essential items. This means your promotional message, creative, and budget must be aligned everywhere.

Why it matters:

It’s not just about Amazon anymore. Shoppers are active across the entire retail landscape, and expect a consistent, compelling offer on every platform.

Action Item:

Ensure your brand’s presence and promotional messaging are unified across channels and leverage real-time data to make adjustments when competitors shift their strategies.

5. The Pacing Playbook: Always-On Optimization

With a four-day event, continuous monitoring and agile adjustment were key.

- CPCs and sales volume shifted by the hour:

- Amazon’s CPC hit $1.49, Target’s reached $1.67, and Walmart’s remained at $0.80.

- Spend spiked on Day 1, plateaued mid-event, then surged again on the final night.

Brands who optimized daily—and even hourly—capitalized on new shopper behaviors, emerging trends, and late-event buying surges.

Why it matters:

There’s no single “right” moment anymore. Every hour is a new opportunity to capture demand.

Action Item:

Use automation and analytics tools for real-time bid and budget management, and be ready to act on signals from performance data as they emerge.

Post-Prime Day—The Opportunity Continues

Prime Day momentum doesn’t stop at midnight. Lower CPCs and persistent buyer intent create a window for cost-effective conversions in the days after the event. The influx of new-to-brand shoppers can be nurtured for ongoing loyalty.

Action Steps:

- Analyze campaign data to identify high-performing strategies and new audience segments.

- Restock and promote bestsellers, manage inventory based on Prime Day results.

- Retarget engaged shoppers using Amazon Marketing Cloud, DSP, and cross-channel tools.

- Apply these learnings to back-to-school and holiday campaigns, building on July’s momentum.

Want More? Download the Full Report July 30th

Are you curious how Amazon’s Prime Day impacted performance across retailers? Want in-depth advertising insights and a comprehensive look at category trends from this year’s Prime Day event? Pacvue’s Prime Day recap report is coming later this month—complete with Q2 benchmarks for the US and EU—to help guide your strategy through the holiday season and beyond.

All stats are preliminary as of July 12, 2025. Final numbers may adjust as reporting windows close.